real property taxes las vegas nv

All other properties are subject to the Other tax rate cap also known as the commercial property tax. Las Vegas NV 89155-1220.

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Tax Rate 32782 per hundred dollars.

. Once every 5 years your home is required to be re-appraised by County Assessors. By E-check or credit card Visa MasterCard. Make Real Property Tax Payments.

LAS VEGAS NV 89130. 111-11-111-111 Address Search Street Number Must be Entered. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

NRS 3614723 provides an abatement of taxes by applying a 3 increase cap on the tax bill of the owners primary residence single-family house townhouse condominium or manufactured home. 5873 GOLD INLET DR. 3635 Death Valley Dr Las Vegas NV 89122 194900 MLS 2392826 Hard to find manufactured home already converted to real property.

You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price. To ensure timely and accurate posting please write your parcel numbers on the check and. Assessment Ratio 35.

The Clark County Treasurer provides an online payment portal for you to pay your property taxes. However businesses in the City of Las Vegas charge. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Office of the County Treasurer 500 S Grand Central Pkwy 1st Floor Las Vegas NV 89106. Clark County mailed out initial real property tax bills over the weekend following a frenzy of residents working to correct their rate in late June. Las Vegas Nevada 89155-1220.

Facebook Twitter Instagram Youtube NextDoor. Road Document Listing Inquiry. You can also obtain the Road Document Listing in either of the.

PROGRAM OF THE GREATER LAS VEGAS ASSOCIATION OR REALTORS MLS. Las Vegas NV 89106. REAL ESTATE LISTINGS HELD BY BROKERAGE FIRMS OTHER THAN THIS SITE OWNER ARE MARKED WITH THE IDX LOGOINFORMATION DEEMED RELIABLE BUT NOT.

123 Main St City State and Zip entry fields are optional. REAL PROPERTY SERVICES City Hall 2250 Las Vegas Blvd North Suite 200 North Las Vegas NV 89030 Phone. The figure you are left with is your capital gain on the property and based on your non-property income you will have to pay up to 30 in federal and state taxes on your capital gains.

702 455-4323 Fax 702 455-5969. Checks for real property tax payments should be made payable to Clark County Treasurer. Apply for a Business License.

Determine the assessed value by multiplying the taxable value by the assessment ratio. You must have either an 11-digit parcel number or the recorded document number to use the Road Document Listing transaction. Real Property Assessed Value Fiscal Year 2021-22.

Las Vegas NV 89106. In Nevada the market value of your property determines property tax amounts. Las Vegas NV 89155-1220.

Find My Commission District. Information on roads and other right-of-way parcels may be obtained by one of the links under the Road Document Listing. Facebook Twitter Instagram Youtube NextDoor.

SURVEY50 East Brooks AvenueNorth Las Vegas NV 89030Phone 702 633 1313Fax 702 633 1909City Survey Gary M. Technically the Las Vegas sales tax rate is between 8375 and 875. Real property tax on median home.

Doing Business with Clark County. 1Determines the amount of the tax required based on the value as represented on the Declaration of Value. The sales tax in Las Vegas varies according to the business location.

Las Vegas NV 89155. Our Rule of Thumb for Las Vegas sales tax is 875. 2Reviews applications for exemption and determines whether the transaction qualifies.

Checks for real property tax payments should be made payable to Clark County Treasurer. Click here for Treasurer. Skip to main content.

Account Search Dashes Must be Entered. Tax District 200. Ad Find Out the Market Value of Any Property and Past Sale Prices.

4Transmits to the State of Nevada all Real Property Transfer Taxes collected minus a. The State of Nevada sales tax rate is 46 added to the Clark County rate of 3775 equals 8375. Property Account Inquiry - Search Screen.

You purchased a rental property 8 years ago for 200000 and put 20 percent down with a standard 6 fixed rate. We encourage taxpayers to pay their real property taxes using our online service or automated phone system. Las Vegas real estate prices steadily decreasing Alonso was at the Clark County Assessors Office to get his property tax reduction.

2 bedrooms 2 fu. Payment Options for Real Property Taxes only Mail. Sales Tax State Local Sales Tax on Food.

Lets see an example of how this formula works. 2 beds 2 baths 1335 sq. Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more.

3Collects the tax when the transfer of property is recorded. LAS VEGAS NV 89147. Real Property Assessed Value Fiscal Year 2021-22.

What is the NV Real Property Tax Abatement. Real Property Tax Auction Information. To ensure timely and accurate posting please write your parcel numbers on the check and include your payment coupons.

Please visit this page for more information. Total Taxable value of a new home 200000. Office of the County Treasurer.

Below you will find an example of how to calculate the tax on a new home that does not qualify for the tax abatement.

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Real Estate And Property Tax Bills Have Been Mailed In York County Wydaily Property Tax Online Taxes Real Estate

Top 4 Reasons Why You Should Buy Anthem Las Vegas Homes For Sale

The Friday Buzz February 14 2020 The Friday Buzz Is Your Place To See All The Happenings In Las Vegas For T Vegas Weather February 14 Las Vegas Apartments

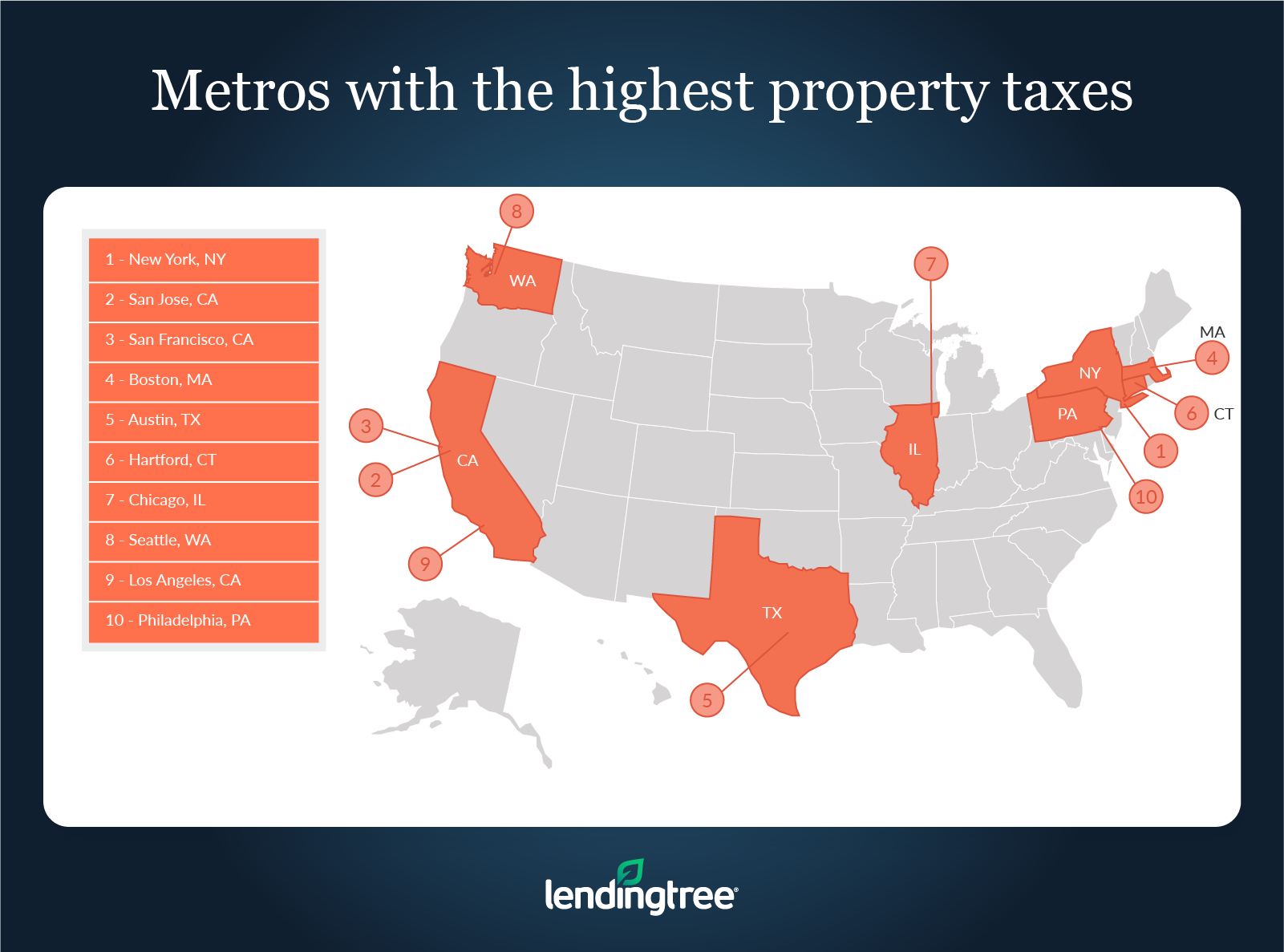

Where People Pay Lowest Highest Property Taxes Lendingtree

Don T Let Rising Inflation Delay Your Homeownership Plans Infographic

Property Tax Prorations Case Escrow

Where People Pay Lowest Highest Property Taxes Lendingtree

5 Reasons To Invest In Las Vegas Real Estate Now Las Vegas Real Estate Investing Real Estate Marketing

Be Sure To Lower Your Property Tax By Filing A Primary Residential Tax Cap Claim Ksnv

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate

Real Estate And Property Tax Bills Have Been Mailed In York County Wydaily Property Tax Online Taxes Real Estate

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

Indian Real Estate Facts Realestateindia Com

Initial Real Property Tax Bills Mailed To Clark County Residents Las Vegas Review Journal

Taxes Don T Have To Be Scary I Can Sell Your House And Save You Money At The Same Time Send Me A Message T Selling House Tax Deductions Selling Your