north dakota sales tax nexus

State Sales Tax The North Dakota sales tax rate is 5 for most retail. If your business has an office or any other.

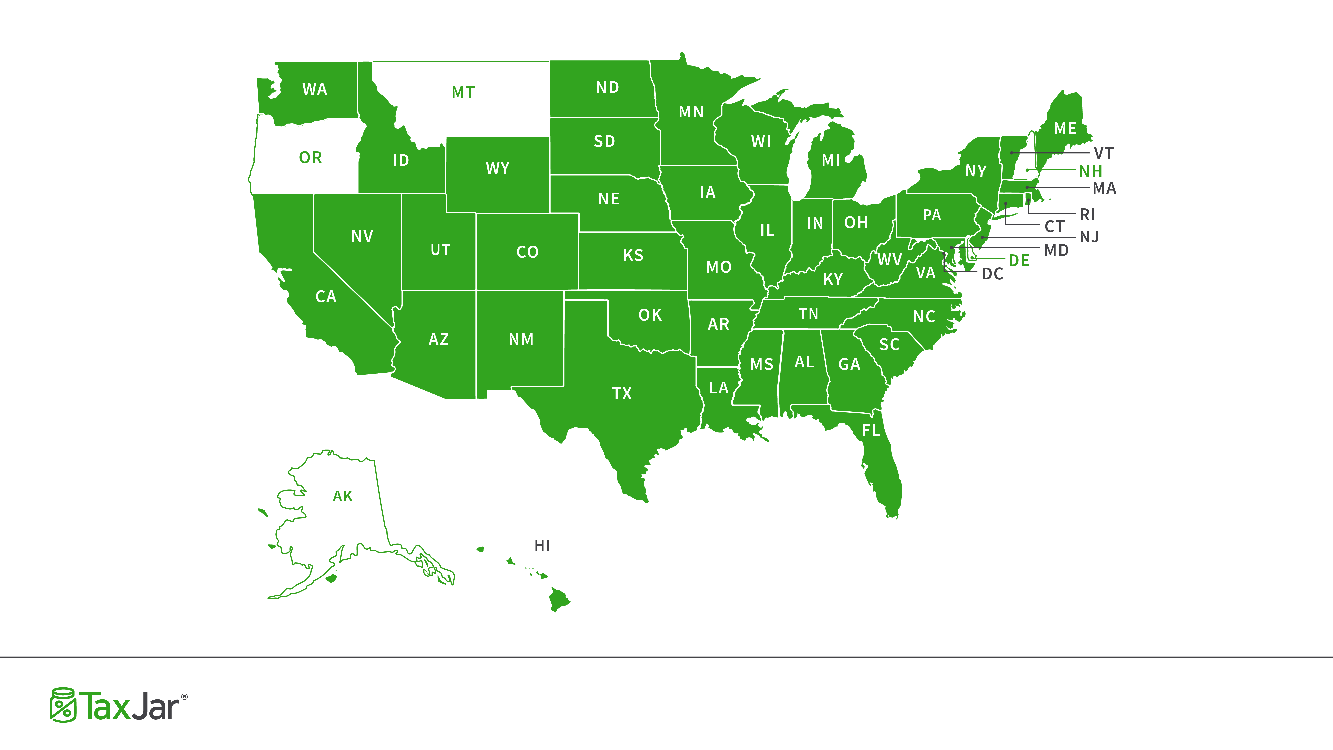

Streamlined Sales Tax Free Solution For Online Sellers

Understand how your online business can be exposed to tax risk.

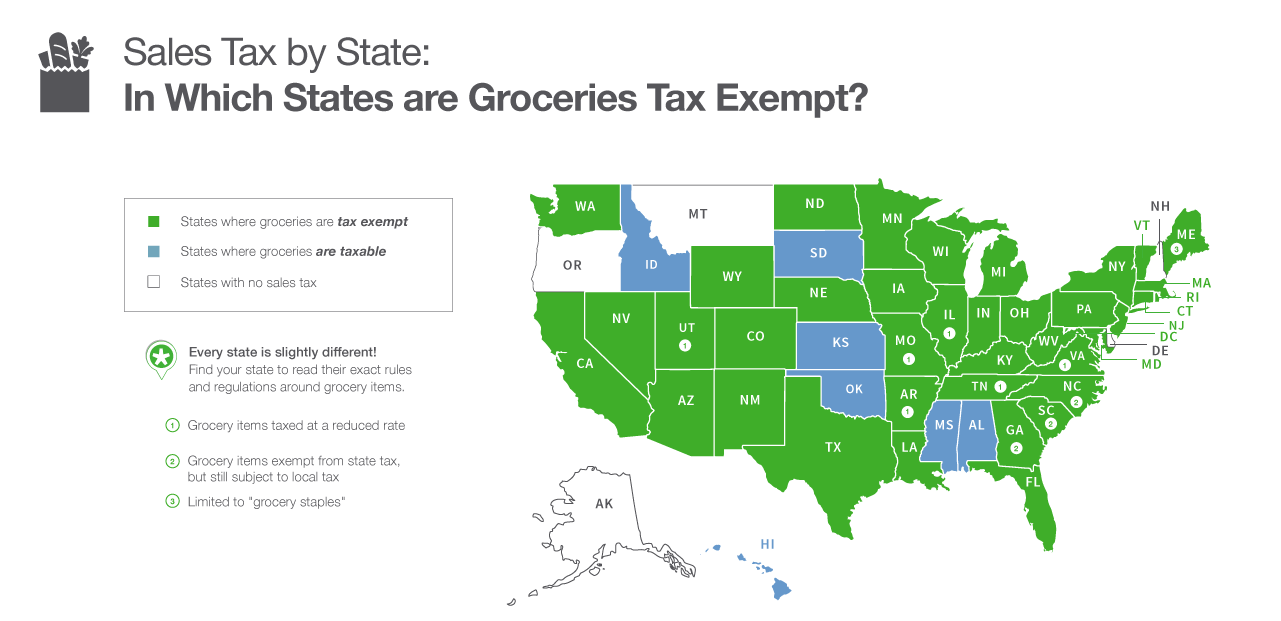

. According to the law of North Dakota all retailers who have tax nexus can be defined in several different ways. North Dakota has a destination-based sales tax system so you have to pay. Every state has a slightly different definition of sales tax nexus and when online sellers need to charge sales tax.

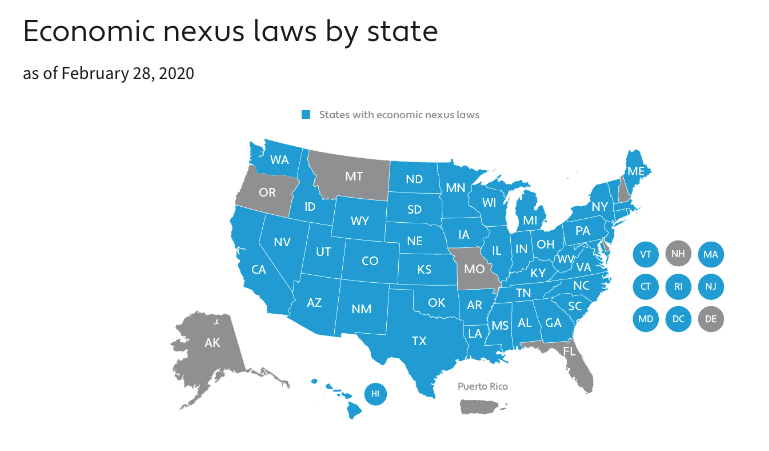

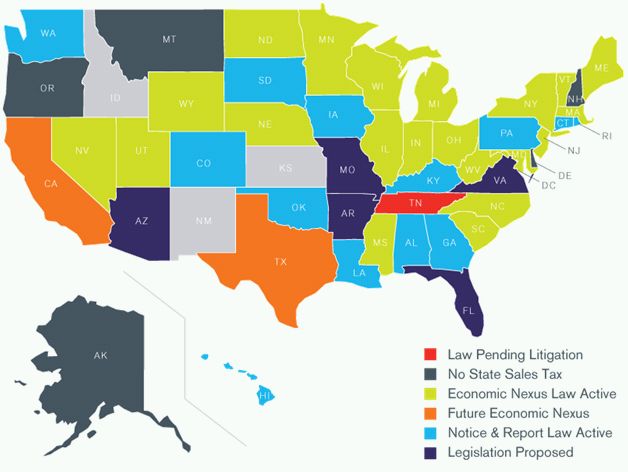

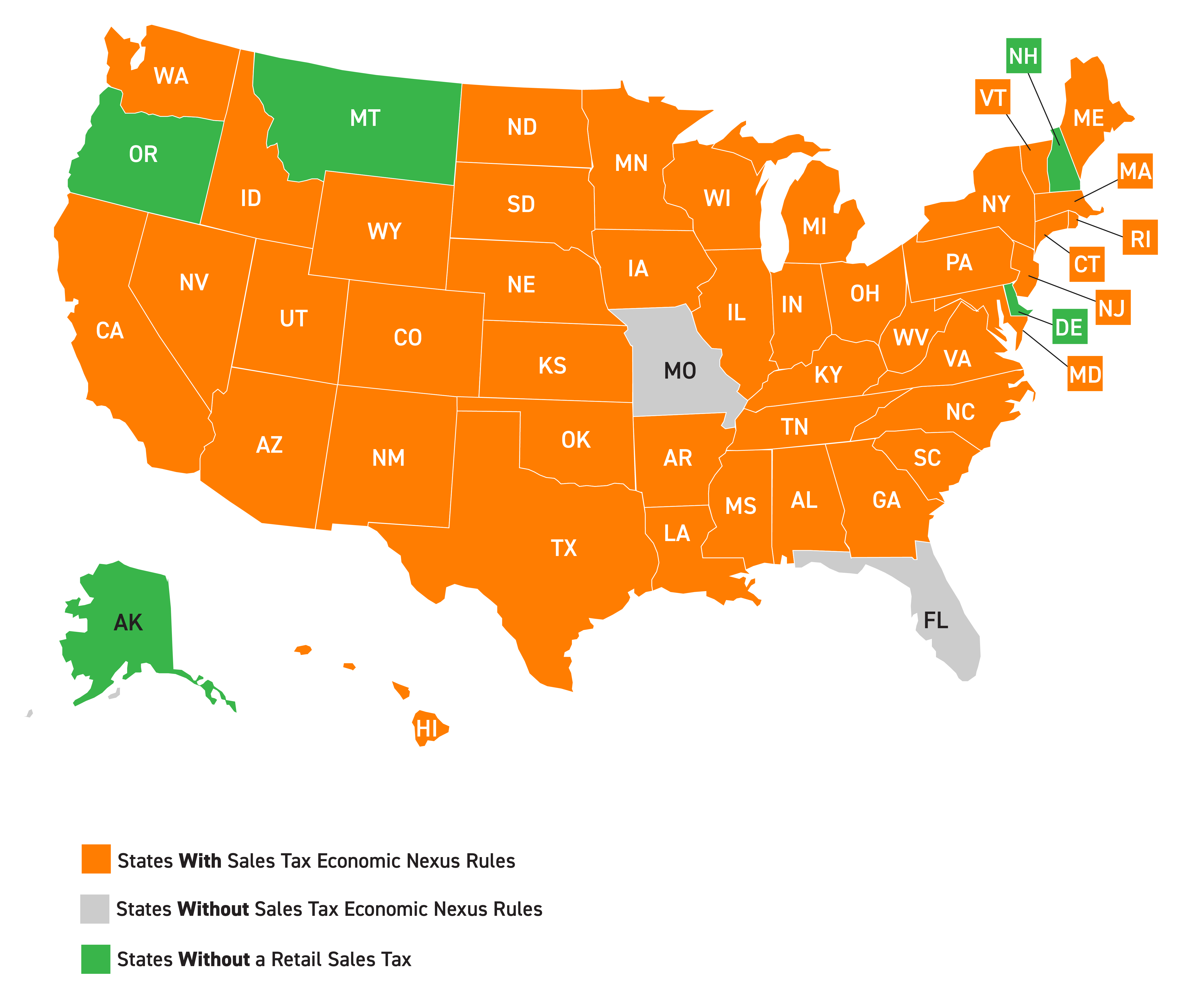

Thursday June 23 2022 - 0900 am. 53 rows Every state with a sales tax has economic nexus requirements for remote out-of-state sellers following the 2018 South Dakota v. The South Dakota v.

The gross receipts from sales of drugs that are sold under a doctors. North Dakota is a destination-based sales tax state. Sales Tax Nexus in North Dakota.

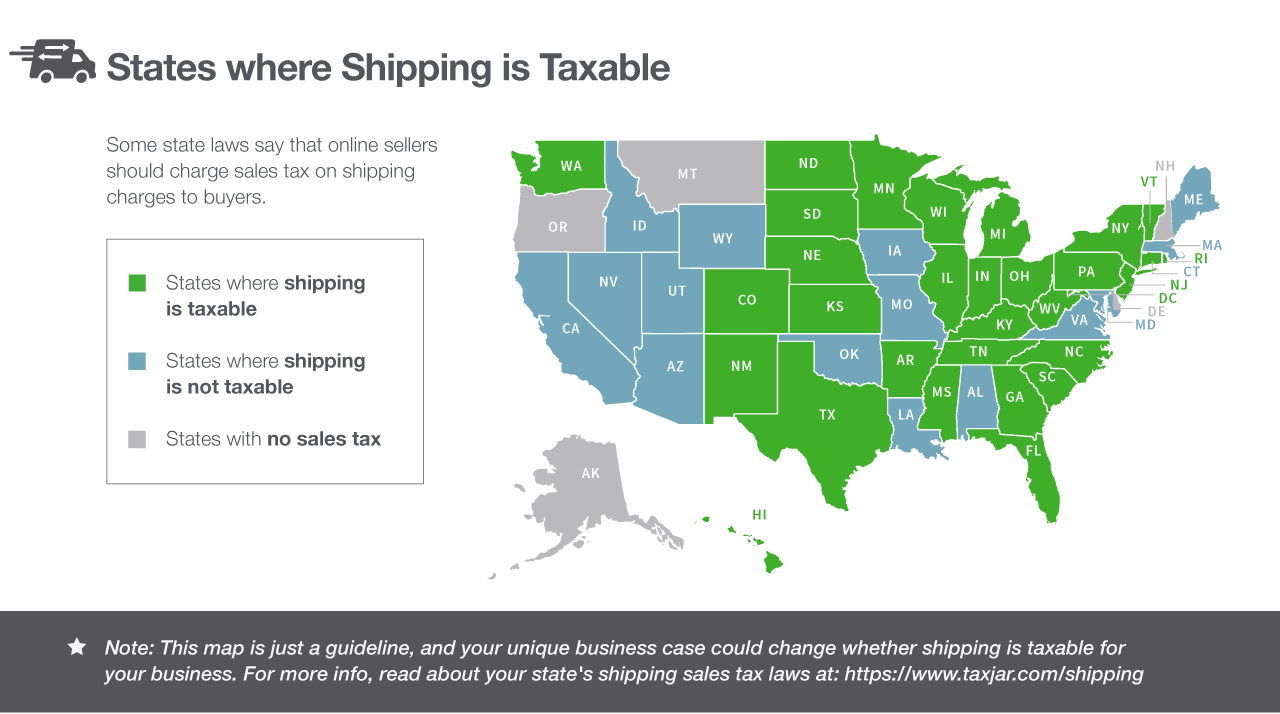

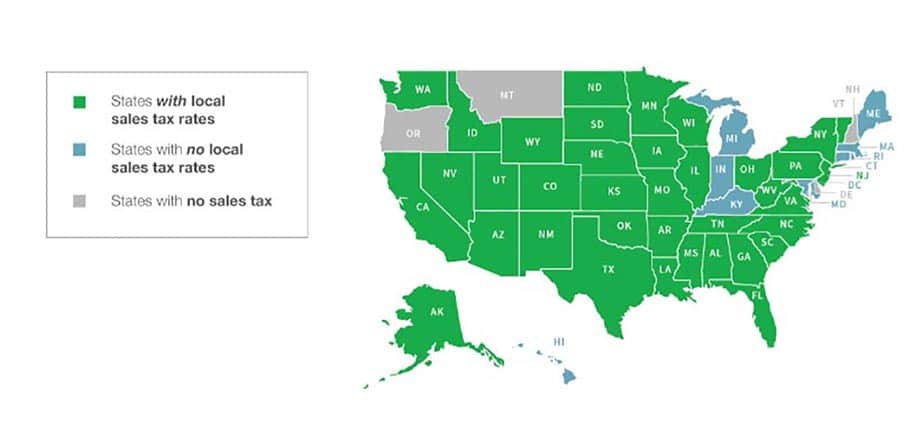

There are additional levels of sales tax at local jurisdictions too. You can read about North. Skip to main content Sales 877-780-4848.

The general sales and use tax rate and the motor vehicle excise tax rate was increased from 55 to 6. Read North Dakotas full notice here. Learn more about different North Dakota tax types and their requirements under North Dakota law.

One of the foundational court cases regarding sales tax nexus Quill Corporation v. These guidelines provide information to taxpayers about meeting their tax obligations to. If not you may be out of compliance.

On March 14 2019 the North Dakota Governor signed SB. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up. Our nexus self-assessment tool can help you determine where to register and collect.

Guideline sales tax includes sales and use tax Products Exempt from Sales Tax A. Our nexus self-assessment tool can help you determine where to register and collect. December 30 2020.

If you had 100000 or more in taxable sales in North Dakota in the previous or current calendar year then you are required to register for collect and pay sales tax to the. Skip to main content. If your business has a sales tax nexus in North Dakota you must charge sales tax.

Nexus info for your states here. 2191 which eliminated the 200 transaction sales tax economic. The rate on farm machinery irrigation equipment farm machinery.

Marketplace facilitators without a physical presence in North Dakota are. Ad Do you know where you have sales tax obligations. If not you may be out of compliance.

North Dakota sales tax is comprised of 2 parts. Ad Do you know where you have sales tax obligations. Out of state sales tax nexus in North Dakota can be triggered in a number of ways.

North Dakota enacted a general state sales tax in 1935 and the rate has since climbed to 5. In North Dakota when do you have to charge sales tax. In addition to the North Dakota sales tax rate there may be one or more local sales taxes and one.

North Dakota took place in North Dakota in 1992. In different states the term sales. Decision pushed many states including North Dakota to adjust their economic nexus laws.

So no matter if you live and run your business in North Dakota or live outside North Dakota but have nexus there you would charge sales tax. Our free online guide for business owners covers North Dakota sales tax registration collecting filing due dates nexus obligations and more. The sales tax is paid by the purchaser and collected by the seller.

Effective October 1 2019 North Dakota has enacted marketplace nexus provisions. After June 30 2019 those remote sellers may cancel their North Dakota sales and use tax permit and discontinue collecting North Dakota sales tax. The state-wide sales tax in North Dakota is 5.

Amazon Sales Tax For Sellers In 2022

E Commerce And Sales Tax Youtube Commerce Sales Tax Ecommerce

The Current State S Of Wayfair Tracking The New Nexus Laws Across The Country Tax Authorities United States

Amazon Sales Tax A Compliance Guide For Sellers Sellics

Which States Get Most Of Their Revenue From Sales Tax Taxjar

What Prompted Sales Tax Nexus Filing Taxes Tax Nexus

How To Register For A Sales Tax Permit In North Dakota Taxvalet

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

Nexus Chart Remote Seller Nexus Chart Sales Tax Institute

Economic Nexus Laws By State Taxconnex

Economic Nexus By State For Sales Tax Ledgergurus

Sales Tax After Wayfair V South Dakota The Legalpreneur Sales Tax Online Business Tax

U S Supreme Court Reversed Decision On Online Sales Tax Collection

State By State Non Collecting Seller Use Tax Guide

How To File A Sales Tax Return In North Dakota

What Is Sales Tax Nexus Learn All About Nexus